In light of the continuous technological development, chatbots are playing an increasingly important role in improving customer service in various industries, especially in the banking and financial sector. This technology presents new opportunities to improve customer engagement and speed up service processes. In this article, we'll look at three ways customer service can be improved in this sector with chatbots.

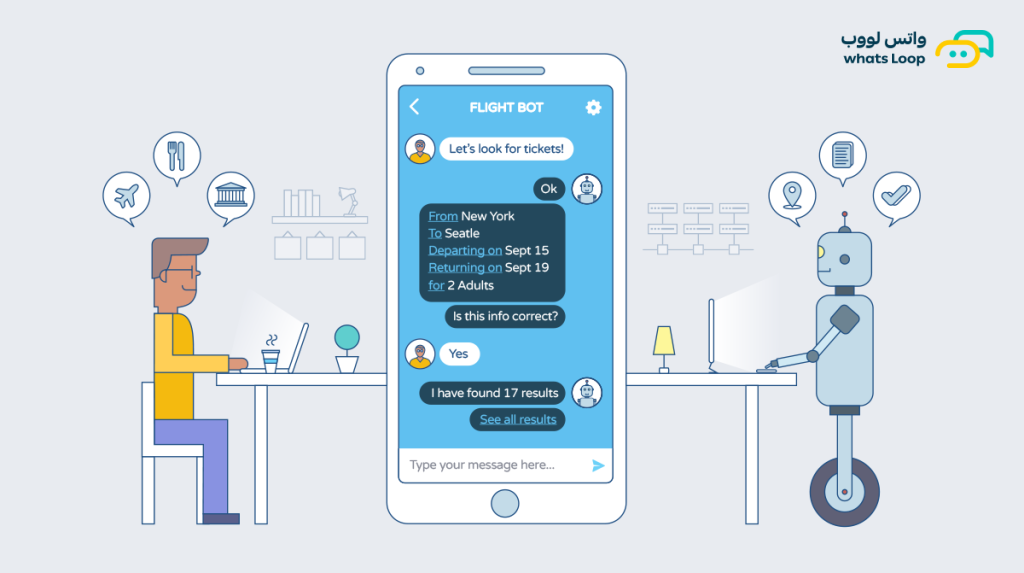

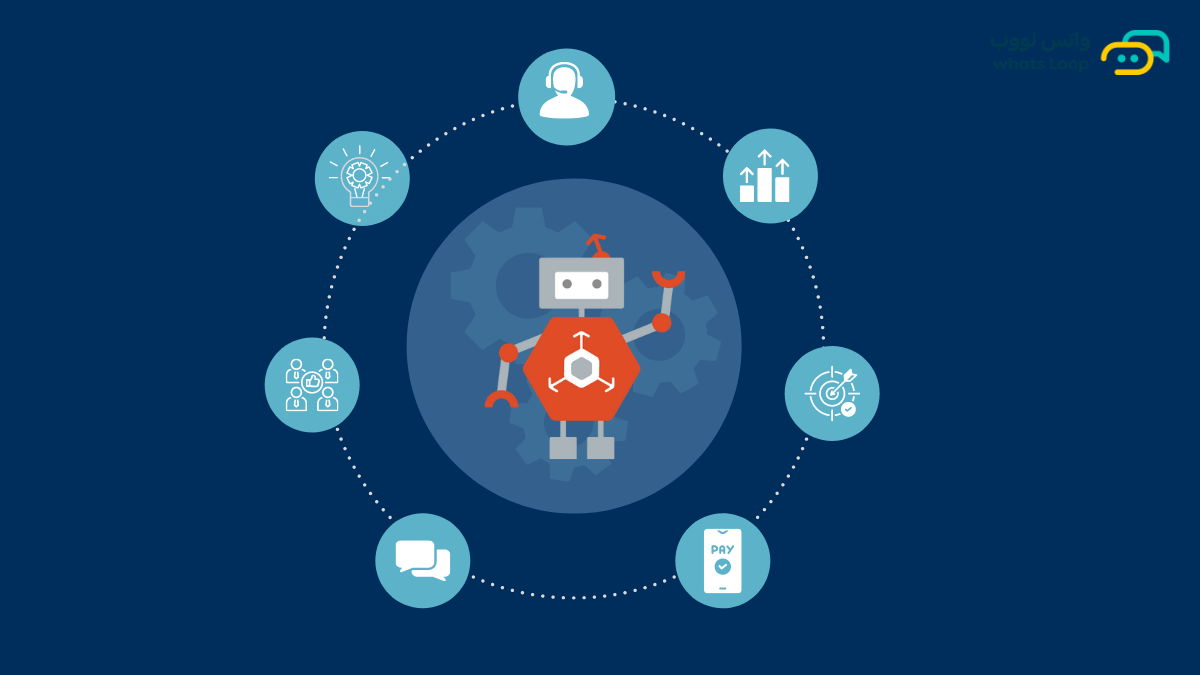

1. Take advantage of chatbots to provide quick and instant information:

In the world of the financial industry, time is of the essence. Chatbots can provide instant answers to customers' queries about balance, accounts, and other banking services. Chatbots can be programmed to provide guidance on how to conduct specific transactions or even provide quick analysis to customers about their financial situation.

2. Customize chatbots to provide advanced customer service:

Using AI techniques, chatbots can be trained to understand customer inquiries more deeply and provide intelligent and advanced responses. Features such as routing to appropriate financial service areas and providing personalized analytics for customer needs can be included, enhancing customer experience and increasing customer satisfaction.

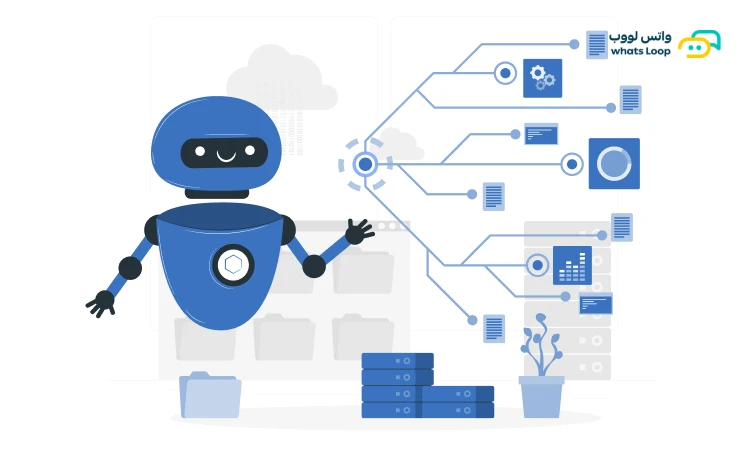

3. Chatbot integration with databases and internal systems:

To ensure the smooth running of the service, chatbot must be integrated with internal databases and banking information systems. This allows the chatbot to access accurate and up-to-date information instantly and reduces the likelihood of errors in the provision of information.

In conclusion, chatbots can be an effective tool to improve customer service in the banking and financial industry. By intelligently employing technology, organizations can improve customer experience and enhance customer satisfaction, contributing to trust and building strong customer relationships.

1. Take advantage of chatbots to provide quick and instant information:

In the modern race of life, customers in the banking and financial industry need to conduct their transactions and get instant information. A quick and accurate response is vital. Chatbots enable this to be achieved thanks to instant and interactive automated responses. It can be programmed to provide information about balances, direct clients to specific actions, and respond to inquiries about transactions in a fast and efficient manner.

2. Customize chatbots to provide advanced customer service:

Chatbots AI technologies offer the ability to better understand the context of conversation and queries. They can be programmed to answer complex questions and provide accurate guidance to customers. AI can be used to analyze customer behavior and make suggestions based on their individual financial needs, enhancing the customer experience and contributing to building more engaged relationships.

3. Chatbot integration with databases and internal systems:

To ensure accurate and up-to-date information is provided, chatbots must be integrated with internal databases and banking information systems. This integration allows chatbot to access customer data instantly, whether it is about their accounts or specific information about banking services. It enables chatbots to provide accurate answers based on this data, and reduces the likelihood of errors or providing outdated information.

By adopting these methods, organizations in the financial sector can enhance the customer experience and, in turn, build stronger and more lasting relationships with their customers.

1. Take advantage of chatbots to provide quick and instant information:

In the world of finance, speed and immediacy are key. Chatbots can provide responses to customer needs 24/7 instantly. It can provide information about accounts, payment procedures, and even provide simple analytics on past financial activities. Thanks to this, customers feel reassured that they are able to access information anytime, anywhere.

2. Customize chatbots to provide advanced customer service:

Chatbots powered by artificial intelligence technologies can understand natural language and handle complex queries. They can be programmed to provide guidance on smart investments, analyze market trends, and even provide guidance on how to improve personal finances. This adds personalization to the interaction, increasing customer satisfaction and boosting loyalty.

3. Chatbot integration with databases and internal systems:

The integration of chatbots with databases and internal systems is essential. This integration allows chatbots to access live and accurate information. This information can be used to provide accurate account details, such as account balance, transfers, and even details of past transactions. This contributes to an end-to-end user experience and reduces the likelihood of miscommunication or incorrect information submission.

By using these methods, financial institutions can enhance their ability to meet customer expectations and needs, contributing to building a strong reputation and positive interaction with customers.

1. Take advantage of chatbots to provide quick and instant information:

In this fast-paced digital age, the immediate provision of information becomes vital. Chatbots in the banking industry can be immensely valuable by providing quick answers to customer questions about billing, balance, financial transactions, and even special offers. Customers can also be guided to better use online banking, facilitating the customer experience.

2. Customize chatbots to provide advanced customer service:

Artificial intelligence technologies open doors to provide advanced customer service. Chatbots can analyze and leverage conversation logs to provide effective and personalized responses. It can be programmed to use natural language analysis to understand more of the context of queries and respond accurately. Investment guidance or personal financial planning tips can also be provided, making the customer experience more enriching.

3. Chatbot integration with databases and internal systems:

Integration with internal databases can be a key factor in improving performance. By linking chatbots to databases, it gives customers access to specific information about their accounts and transactions. This information can be used to provide more accurate details about spending, saving, and investing. It can also be used to analyze personal financial trends, contributing to better personalized customer service.

By employing these strategies, financial institutions can progress towards a new level of interaction and service to their customers. These technologies can drive digital transformation and deliver an unforgettable customer experience, fostering positive interaction and contributing to building trust-based relationships.

1. Take advantage of chatbots to provide quick and instant information:

With continuous technological advancements, chatbots continue to improve the customer experience in banks. These bots can be programmed to provide instant answers about transactions, balances, and account details. They can be customized to guide customers step-by-step through financial operations, whether it's making a transfer or paying an invoice. This provides the kind of instant service that customers look forward to in a fast and efficient time.

2. Customize chatbots to provide advanced customer service:

Using AI techniques, chatbot's capabilities can be enhanced in understanding context and providing accurate and advanced responses. The bot can interact intelligently with clients, whether it's providing investment guidance based on financial objectives or even account performance analytics. These analytical abilities can be improved over time as the bot learns from the pattern of previous queries and interactions.

3. Chatbot integration with databases and internal systems:

Seamless integration with databases and internal information systems can bring about a paradigm shift in customer experience. Chatbots can quickly access sensitive information such as account details and current transactions. Additional features such as spending tracking and providing analytical monthly reports can be included. This integration increases bot effectiveness and makes the customer experience more comprehensive and personalized.

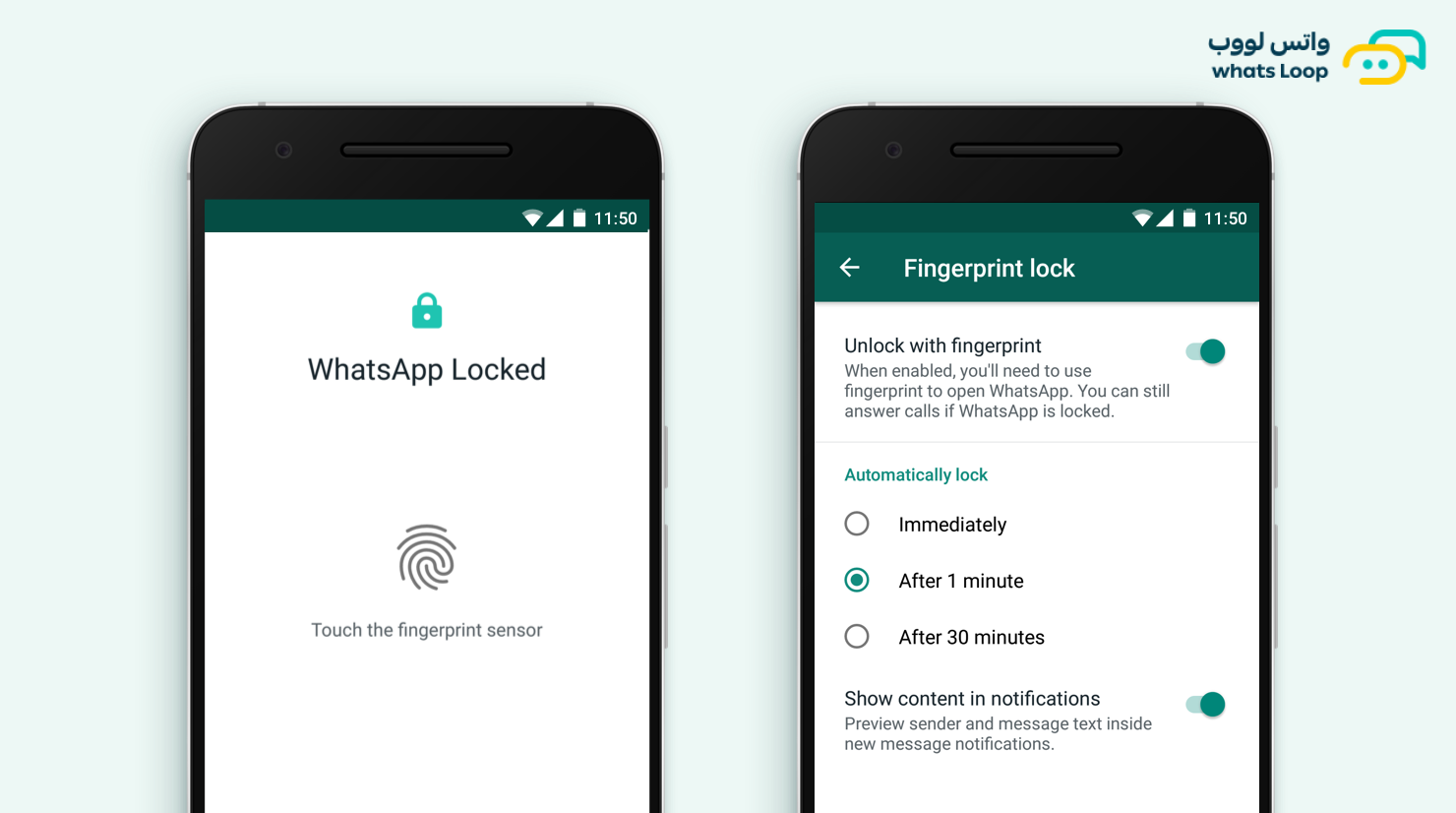

4. Improve security and privacy:

Continuous improvement of security and privacy should be at the heart of your chatbot strategy. This can be achieved through the use of advanced encryption techniques and ensuring the confidentiality of financial information. The bot can also guide customers on digital security measures, enhancing awareness and maintaining customer trust.

By taking full advantage of the capabilities of chatbot and integrating it with the latest technology, financial institutions can build strong relationships with their customers and deliver an unforgettable experience. Improving communication, providing quick responses, and directing customers towards appropriate financial solutions can lead to customer satisfaction and enhance a brand's reputation in the money market.

1. Take advantage of chatbots to provide quick and instant information:

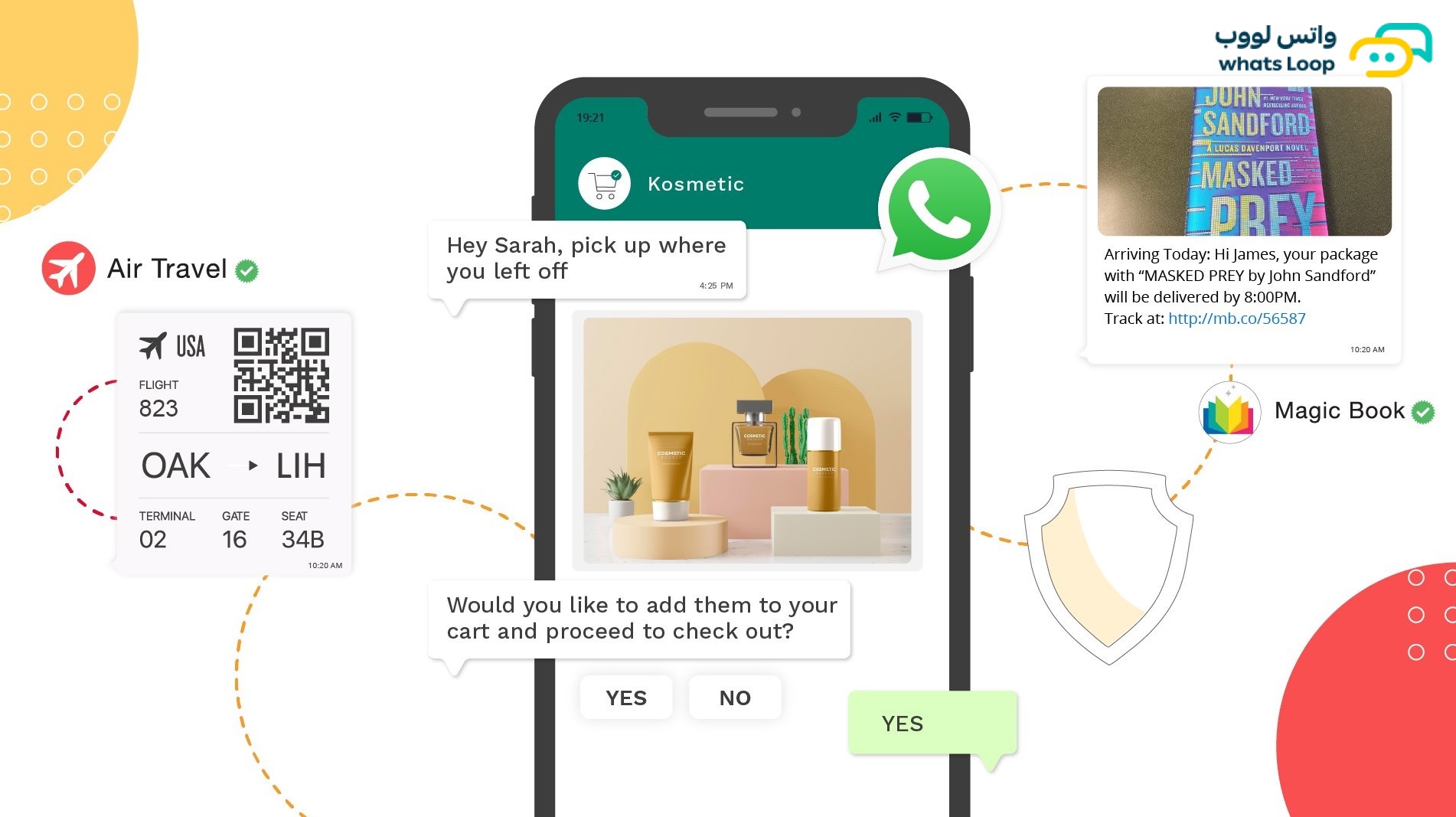

Chatbots can be more than just a virtual employee providing information. They can be customized to provide comprehensive details about banking services, such as providing guidance on how to improve personal money management or analyzing available offers and benefits. It can also be integrated with electronic payment systems to carry out instant financial transactions.

2. Customize chatbots to provide advanced customer service:

Exploiting artificial intelligence in chatbot training enables it to learn customer behavior models and continuously improve its interaction with them. The bot can recognize spending patterns and provide more accurate guidance, based on financial data analytics. This enhances personal interaction and serves to achieve a unique customer experience.

3. Chatbot integration with databases and internal systems:

Improving chatbot integration with internal systems can achieve an increase in efficiency and accuracy. The bot can be designed to respond to specific inquiries about transactions or interact with information systems to provide more detailed reports on financial activity. In addition, it can update customers about changes to policies or services periodically.

4. Improve security and privacy:

Providing a secure and reliable environment is vital for financial institutions. Chatbot can meet these needs by applying the latest encryption and security technologies. The bot can also be trained to guide customers on online security practices and how to protect their bank accounts.

5. Enhance customer experience with technology:

Using technology can be more innovative by embedding graphical user interfaces (GUIs) in conversations to improve customer interaction and experience. Features such as face recognition or machine learning can also be added to create more integrated and comprehensive responses.

By diversifying and integrating these points, financial institutions can deliver a comprehensive and improved customer experience. This further enhances customer interaction and connectivity with financial services, contributing to strong relationships and competitive market excellence.

1. Take advantage of chatbots to provide quick and instant information:

Improving customer service means achieving a deep understanding of the customer's needs. Chatbots can be programmed to provide detailed information about banking and investment services and even new services that they may be interested in. Detailed analytics and instant responses can be combined to meet diverse customer expectations.

2. Customize chatbots to provide advanced customer service:

Engaging with customers in an advanced way means understanding the history of past transactions and potential future needs. Chatbots can be programmed to provide customized investment recommendations based on the analysis of individual financial patterns. Periodic inquiries about customer satisfaction and suggestions for improving services can also be made.

3. Chatbot integration with databases and internal systems:

Internal databases serve as a rich source of information. Chatbots can be periodically updated from these rules to ensure accurate and up-to-date information is provided. By collecting data from multiple sources, the bot can develop deeper insights into the bank's customers and provide more detailed analytics to improve services.

4. Improve security and privacy:

Enhancing security includes updating encryption strategies and adopting advanced protection techniques to prevent security breaches. The bot can be integrated with fraud detection systems to verify transactions and ensure the integrity of financial information. Customers can also be guided on how to keep their personal information private.

5. Enhance customer experience with technology:

GUI integration can greatly improve the user experience. Elements such as illustrations, pictograms, or even augmented reality technologies can be added to improve customer communication with chatbots. This enhances the personal experience and increases customers' understanding of the information provided.

By diversifying and improving these points, financial institutions can comprehensively improve their services and improve the customer experience. The pillar on leveraging data, driving services, and enhancing security forms a powerful combination to foster positive interaction and build strong customer relationships.

1. Take advantage of chatbots to provide quick and instant information:

Details could include the use of deep learning techniques to improve the chatbot's ability to recognize the context of the question, thus providing more accurate answers. Autoresponders can also be improved by training language models with advanced financial vocabulary and sentences.

2. Customize chatbots to provide advanced customer service:

In terms of improving the delivery of investment guidance, predictive analysis systems can be integrated to provide accurate recommendations based on transaction history analysis and client guidance. Communication with customers can be enhanced by interacting with them on social media platforms to better understand their needs.

3. Chatbot integration with databases and internal systems:

To enhance search efficiency, the chatbot database can be improved periodically and can be quickly updated to reflect changes in financial information and customer details. The user experience can also be enhanced via image and graph integration to provide visual insights into financial information.

4. Improve security and privacy:

Encryption technology can advance much more. Intelligent security threat detection technologies can be integrated to monitor and analyze behavior patterns to identify any unusual or suspicious activity in real time. Customer privacy can also be enhanced by providing instructions on how to protect their accounts and encouraging the use of advanced identity verification methods.

5. Enhance customer experience with technology:

Details here can include incorporating advanced technological interactions such as voice recognition and voice chats to enhance the customer experience. In addition, user interfaces can be developed to be more intuitive and simple, contributing to enhanced customer engagement.

6. Interaction with customers at a comprehensive level:

Within the sixth point, advanced analytics can be used to understand customer behavioral trends and identify areas that can be improved. Personalized automatic responses can be included based on the overall economic context and its impact on customers.

Through integration and continuous improvement, chatbots can play a greater role in improving the customer experience in the banking and financial industry. Advanced and targeted details that can add additional value to customers and differentiate banking and finance services in the market.

1. Take advantage of chatbots to provide quick and instant information:

This point can be enhanced by developing an intelligent markup system that leverages big data analytics to determine future customer needs. Using predictive analysis techniques can lead to providing more accurate guidance based on financial behavior predictions.

2. Customize chatbots to provide advanced customer service:

Improving the ability to integrate with other platforms such as mobile banking apps and digital payment systems enhances the customer experience. Chatbot language comprehension and cultural sensitivity can also be improved to guide customers effectively and in response to their changing needs.

3. Chatbot integration with databases and internal systems:

Improving the user experience can include adding features such as natural language interaction with financial statements, making interaction with chatbots easier and more effective. Intelligent linking techniques can also be used to quickly access specific information from databases.

4. Improve security and privacy:

The integration of suspicious behavior recognition systems can enhance the bot's ability to detect any unusual or suspicious activity. Interaction with customers can be improved by providing specific tips on how to stay away from fraud attempts and keep their accounts secure.

5. Enhance customer experience with technology:

Developing user interfaces can include adding voice interaction features or using augmented reality technologies to provide more advanced interactive and visual experiences. The interaction pattern can also be analyzed to ensure a smooth and improved user experience.

6. Interaction with customers at a comprehensive level:

Big data analytics integration can form deep details about customer preferences and future directions. This information can be used to improve investment guidance and provide more personalized financial services.

By continuously innovating in these areas, financial institutions can achieve an evolution in customer experience and chatbot technology, positioning them in a leading position to meet the evolving needs of customers in the banking and financial industry.

1. Take advantage of chatbots to provide quick and instant information:

Machine learning technology can continuously improve chatbot's ability to adapt to a customer's language and understand the context of complex questions. Directing investments can be improved by analyzing personal financial statements and making recommendations that fit the client's objectives and acceptable risk level.

2. Customize chatbots to provide advanced customer service:

The provision of investment guidance can be further enhanced by integrating predictive analysis techniques with artificial intelligence. The bot can learn from the customer's past transaction history and decisions to deliver advanced and harmonious responses.

3. Chatbot integration with databases and internal systems:

Improving bot integration with databases also includes the use of advanced search techniques and improving the performance of database queries. The bot can be guided to search historical data and past transactions more effectively to provide accurate answers.

4. Improve security and privacy:

Security can be improved via bot integration with the latest information protection technologies, including data encryption and fraud detection. Customers can also be offered personalized advice on how to enhance the security of their accounts and avoid potential risks.

5. Enhance customer experience with technology:

The development of user interfaces can include the integration of augmented reality technologies to deliver more realistic and effective interactions. Voice interaction can be improved to make the process more natural and smooth.

6. Interaction with customers at a comprehensive level:

Advanced analytics can be used to better understand customer needs and provide personalized services. This information can be used to design targeted marketing campaigns or improve existing services based on customer behavior.

7. Continuous improvement and integration:

Strengthening these points requires constant interaction with technological developments. Machine learning can be used to improve chatbot performance over time and integrate continuous updates of analytics and information security techniques.

In continuously developing and integrating these aspects, chatbot can become a more effective and interactive tool in providing advanced financial services and improving the customer experience in the banking and financial industry.

1. Take advantage of chatbots to provide quick and instant information:

The performance of a chatbot can be improved by continuously improving its database, which contributes to improving its ability to provide accurate and fast information. Machine learning techniques can also be used to enhance their understanding of complex context and phrases, making the user experience smoother and more effective.

2. Customize chatbots to provide advanced customer service:

Exploiting predictive analysis technology allows chatbots to better understand customer expectations and needs. It can be integrated with investment analysis systems to identify potential investment opportunities and provide accurate recommendations.

3. Chatbot integration with databases and internal systems:

Improving the integration of chatbots with databases includes improving search efficiency and increasing the ability to comprehensively review data. It can also be integrated with CRM systems to achieve more comprehensive insights into customer interaction.

4. Improve security and privacy:

Providing sustainable security requires modern technology for encryption and threat detection. Chatbot guidelines can be improved to encourage customers to adopt good security practices, such as using strong passwords and avoiding sharing sensitive information.

5. Enhance customer experience with technology:

Improving technology integration can include developing new, more interactive user interfaces, and integrating with audio and video devices to enhance communication and understanding. Predictive analytics can also be integrated to understand customer preferences and deliver responsive services.

6. Interaction with customers at a comprehensive level:

Understanding of customers can be improved more deeply by analyzing the interaction data generated by long and short cycles. This information can be used to improve communication and bot integration with the changing needs of customers.

7. Continuous improvement and integration:

Continuous improvement integration means chatbots are regularly updated based on industry changes and in response to changes in customer needs. This can allow the chatbot to stay modern and effective.

By diversifying and integrating these points, chatbots can deliver a comprehensive and advanced experience in the banking and financial services industry, fostering positive interaction and building strong customer relationships.

.png)