What's loop Platform

Whats Loop Platform enables you to communicate with your customers effectively, professionally and highly efficient Log in anytime, anywhere- Home

- ABOUT US

-

SOLUTION

-

-

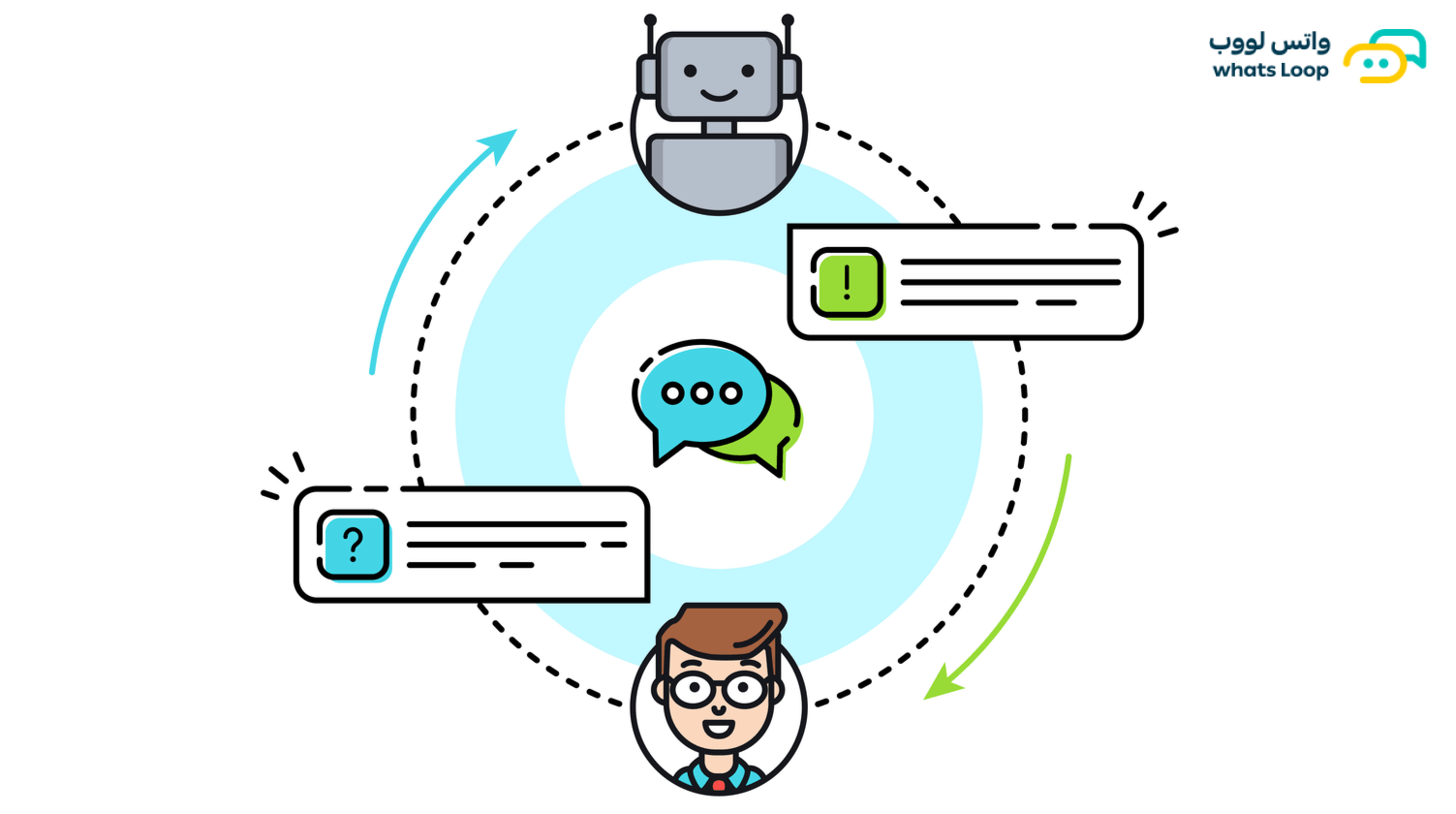

WhatsApp Loop Bot

Provide remarkable services around the clock with the Whats Loop Bot and through WhatsApp, using an automated and artificial intelligence customer service representative. -

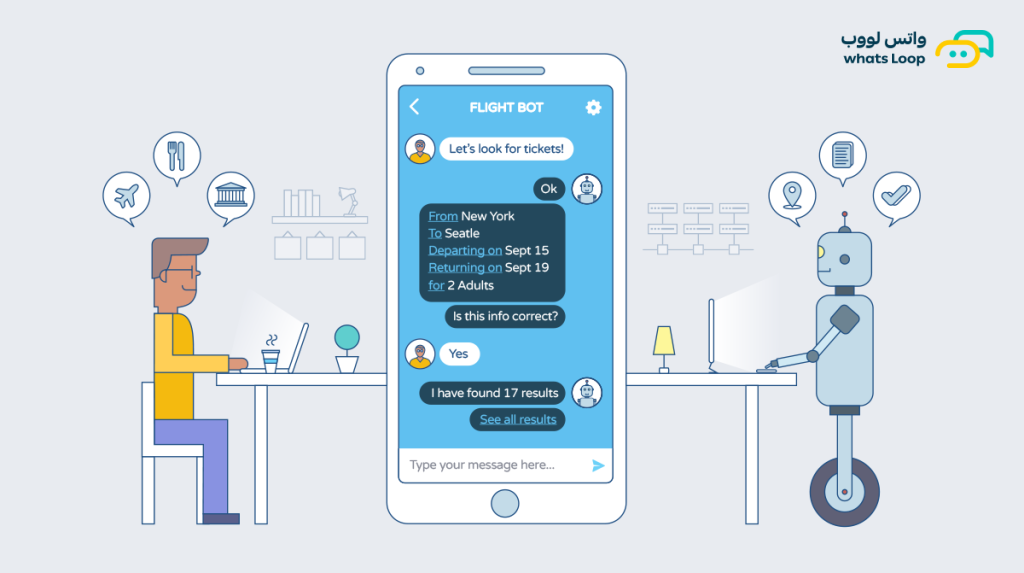

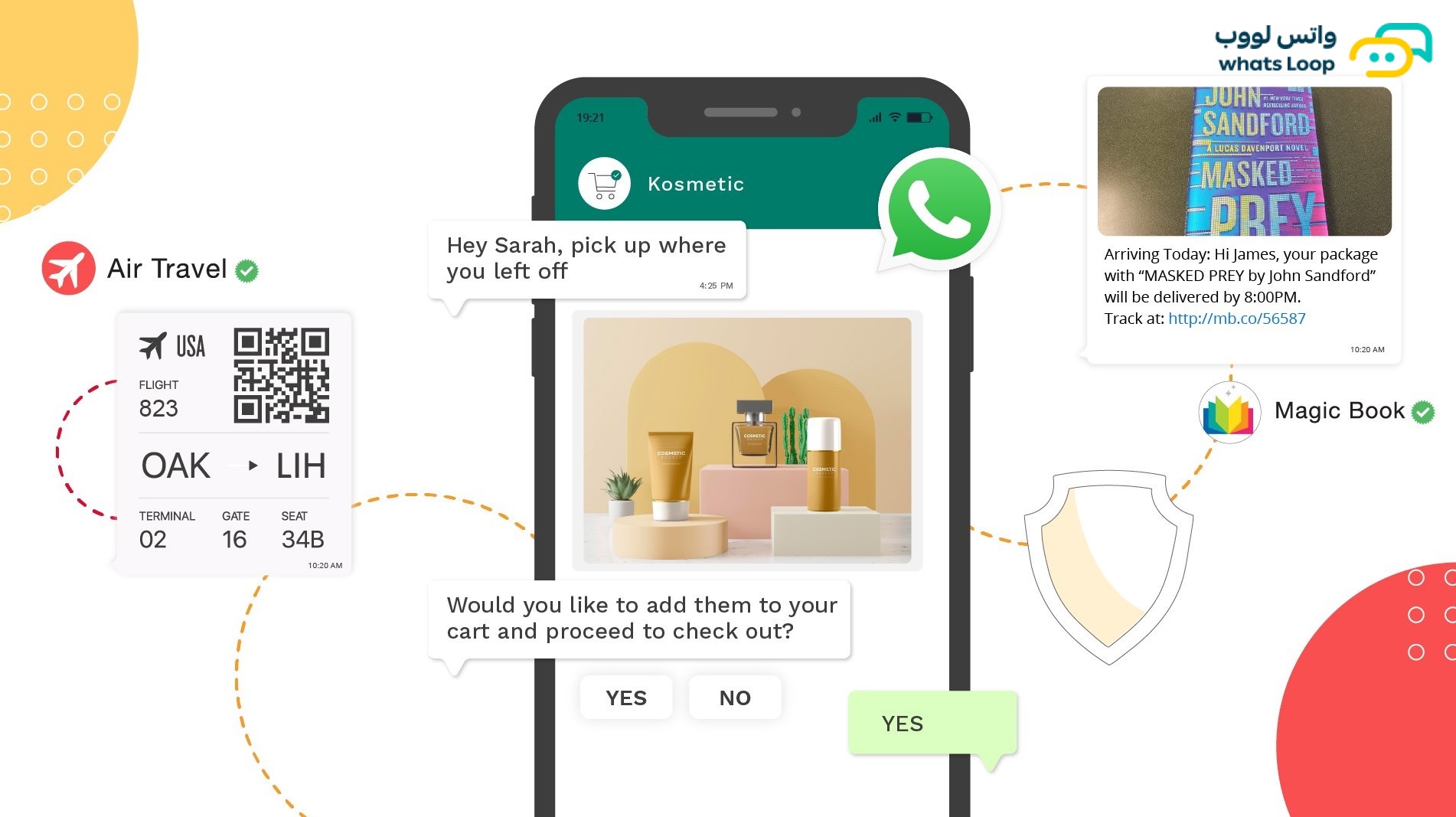

Whats Loop API

Connect with your customers in an innovative way by interacting in a more personalized conversation using the messaging app

.png)

Are you looking for a customized service? Phone call

-

- PRICING

- THE BLOG

- CONTACT US

-

More

devolpers

-

Getting started guide

The interactive WhatsApp Loop platform enables you to communicate Effectively, professionally and efficiently interact with your clients -

Software Link Manual

The interactive WhatsApp Loop platform enables you to communicate Effectively, professionally and efficiently interact with your clients -

Programmers Blog

The interactive WhatsApp Loop platform enables you to communicate Effectively, professionally and efficiently interact with your clients

Are you looking for a customized service? Phone call

-